Kevin Suh, NetSuite Administrator

Recent Posts

Create AR Aging Report using Saved Search

Tags: NetSuite, ERP, NetSuite Partner, NetSuite How To's, NetSuite Tips, Shortcuts, dashboard

Create AP Aging Report using Saved Search

Tags: NetSuite, ERP, NetSuite Partner, NetSuite How To's, NetSuite Tips

Handling Duplicate Dashboard Shortcuts

Introduction

Duplicate dashboard shortcuts can lead to confusion, clutter, and inefficiencies in system navigation. This guide outlines the process for identifying and resolving duplicate shortcuts to ensure a streamlined and user-friendly dashboard experience.

Tags: NetSuite, ERP, NetSuite Partner, NetSuite How To's, NetSuite Tips, Shortcuts, dashboard

Accept Customer Payment for Invoice in Different Currency

Introduction

With the Multi-Currency Customers feature in NetSuite, users can assign a primary (base) currency to a customer and define additional currencies for transactions with them.

However, when trying to apply a customer payment in a different currency than the invoice, users will notice that the invoice does not appear under Transactions > Customers > Accept Customer Payments, unless the payment and invoice use the same currency.

Example Scenario

- Customer's Primary Currency: CAD

- Invoice Currency: CAD

- Intended Payment Currency: USD

Tags: NetSuite, ERP, NetSuite Partner, NetSuite How To's, NetSuite Tips, Currency

Bank Statement Import using CSV File

You can download a financial statement file from your bank or financial institution and manually upload it to NetSuite for reconciliation or expense tracking. During processing, NetSuite encrypts financial data files for security. Once processing is complete, the files are deleted and not retained. When you import data for bank or credit card reconciliation, NetSuite applies reconciliation rules to automatically match the imported bank lines with corresponding account transactions.

Tags: NetSuite, ERP, Reporting, NetSuite Partner, NetSuite How To's, NetSuite Tips, Shipping, SuiteScript

Important Update for Shipping to Germany

UPS has a new regulatory requirement for shipping to Germany. Starting January 1, 2025, shipments weighing 10 kilograms or more will require clear weight labeling to meet compliance laws.

- 10-20kg packages: A 10+ KG icon must be displayed on the shipment.

- 20kg and above packages: A 20+ KG icon must be displayed on the shipment.

Tags: NetSuite, ERP, Reporting, NetSuite Partner, NetSuite How To's, NetSuite Tips, Shipping

Serial and Lot Inventory with Multiple Units of Measure

Using Multiple Units of Measure alongside Serialized Inventory or Lot Tracking gives you greater flexibility in handling sales, purchases, and inventory transactions for items in various units.

Tags: NetSuite, ERP, Project Management, Reporting, NetSuite Partner, NetSuite How To's, NetSuite Tips

The Multiple Units of Measure feature allows you to define different units for stocking, purchasing, and selling inventory items, as well as tracking non-monetary accounts.

Tags: NetSuite, ERP, Project Management, Reporting, NetSuite Partner, NetSuite How To's, NetSuite Tips

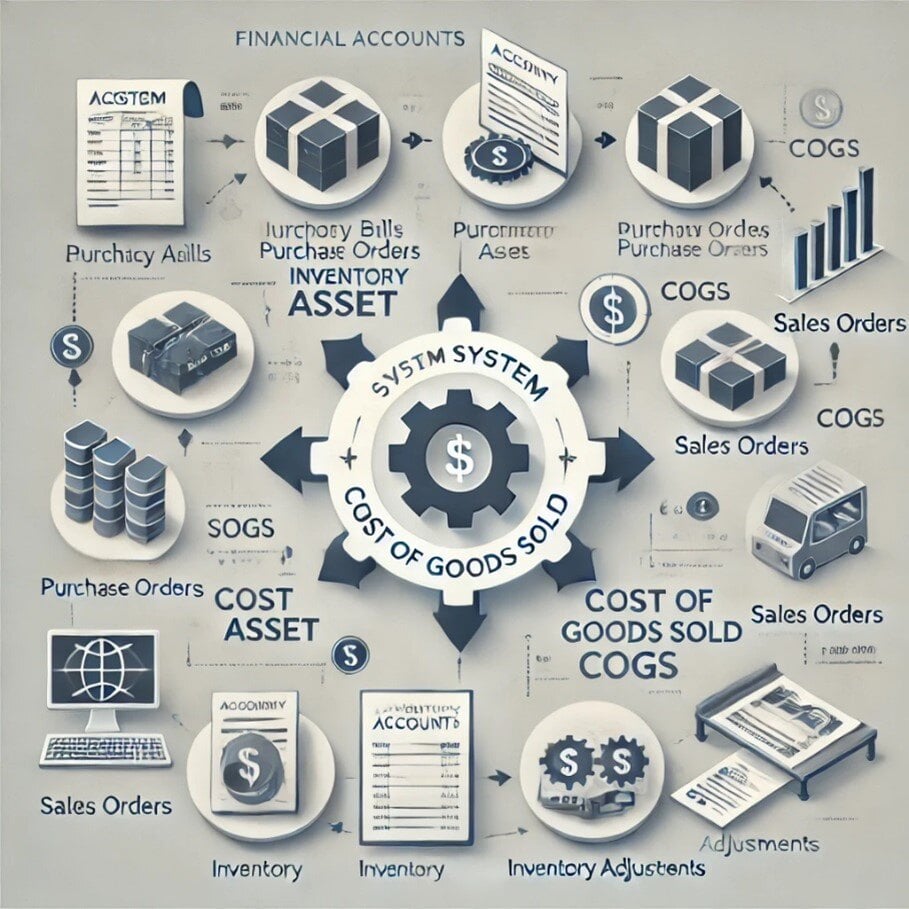

System Cost of Goods Sold Adjustments

When an in-stock item is sold, NetSuite decreases the inventory asset account balance and increases the Cost of Goods Sold (COGS) account balance. If an out-of-stock item is sold, NetSuite adjusts the on-hand value of that item with what's known as a "system COGS adjustment," which can appear on financial reports or within transactions.

Tags: NetSuite, ERP, Reporting, NetSuite Partner, NetSuite How To's, NetSuite Tips

CSV Import of Kit/Package Item record

Item records allow you to track and manage the goods and services your company buys and sells in the course of doing business. This can be done by using two files during the upload: one is for Primary, the other is for Item Members. Below are the steps:

Tags: NetSuite, ERP, Reporting, NetSuite Partner, NetSuite How To's, Inventory Management, NetSuite Tips, CSV Import