NetSuite's Fixed Asset Management SuiteApp incorporates the Lease Accounting feature, aligning with the IFRS 16 and ASC 842 standards for lease compliance. These regulations mandate that lessees include almost all leases on their balance sheet, a change implemented from January 1, 2019 onwards.

Lessees must categorize leases as either operating or finance, depending on specific criteria defined within these standards. In finance leases, where the lessee's involvement is akin to ownership, two key entries are made on the balance sheet: the right-to-use asset and a lease liability. With each lease payment, the lessee simultaneously amortizes the asset, reduces the lease liability, and recognizes interest expense in the income statement. On the other hand, in an operating lease, which resembles a rental arrangement more than ownership, the lessee follows similar steps to record the right-of-use asset and a lease liability on the balance sheet. However, the expense is accounted for as amortization expense within the income statement.

For finance leases, the lessee records the right-of-use asset and amortizes it over the lease's duration. Additionally, a lease liability is recorded, with each lease payment comprising a portion that reduces the lease liability and the remainder increasing the interest expense.

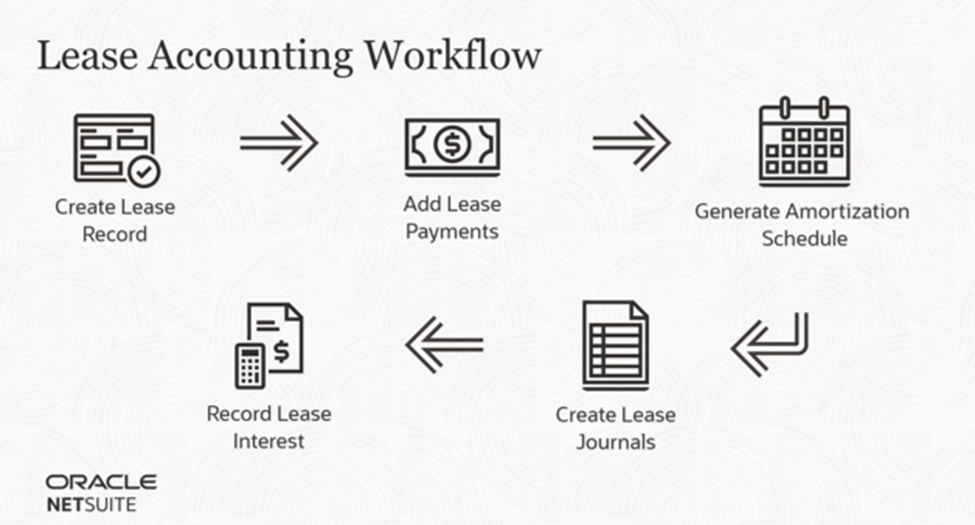

To effectively document lease transactions, a series of steps must be executed:

- Create a Lease Record:

- In this lease record, lease payments are generated, and an amortization schedule is created to calculate the interest and net present value associated with each payment.

- Create the Lease Asset Record:

- After generating the amortization schedule, an asset record is established to facilitate the management of interest recording.

- Record Lease Interest:

- Similar to the depreciation process, the fixed asset management module is utilized to generate journal entries, capturing the interest and lease liability impacts for the monthly lease payment.

For specific, detailed instructions on how to execute each of these steps, you can refer to NetSuite's official documentation: https://docs.oracle.com/en/cloud/saas/netsuite/ns-online-help/chapter_1543968584.html#Fixed-Assets-Lease-Accounting.

Alternatively, if you require assistance in implementing lease assets within NetSuite's Fixed Asset Management module, feel free to reach out to Concentrus for expert guidance. They can provide you with the support needed to seamlessly integrate this accounting workflow into your business operations.

About Us

Concentrus is a leading provider of innovative cloud-based enterprise resource planning (ERP) solutions, including NetSuite. Our team of NetSuite experts offers a range of services, including NetSuite price analysis, NetSuite training, and NetSuite integration services.

Our goal is to help businesses of all sizes maximize their investment in NetSuite by providing expert NetSuite cost optimization and implementation strategies. With years of experience as a NetSuite partner, our NetSuite administrators and NetSuite consultants are well equipped to help businesses of all sizes with their NetSuite consulting needs.

Whether you're looking for a NetSuite consultant to help with your NetSuite implementation or you need ongoing NetSuite support, Concentrus is here to help.

Read About Our Implementation Methodology

Want more NetSuite Tips and Tricks? Check out our Short & 'Suite videos