Have you noticed small increments of one or two pennies in your A/R Aging report? Do you have some bad debt that you need to write off your books due to unresponsive clients? The following process will walk you through how to enter a Journal and process the customer payment to remove these from your Accounts Receivable reporting.

First you’ll need to create a Journal entry to move the amount owed to bad debt.

Create a Journal Entry

- Go to Transactions > Financial > Make Journal Entries.

- Select a subsidiary to associate with this journal entry.

- If you have journal approval permission, check the Approved box to approve your journal entry. If you do not check this box, this entry does not post until it is approved.

- Ensure Date is correct, you may want to update to post at the end of the most open period/quarter if cleaning up prior period.

- Correct Posting Period to match Date provided.

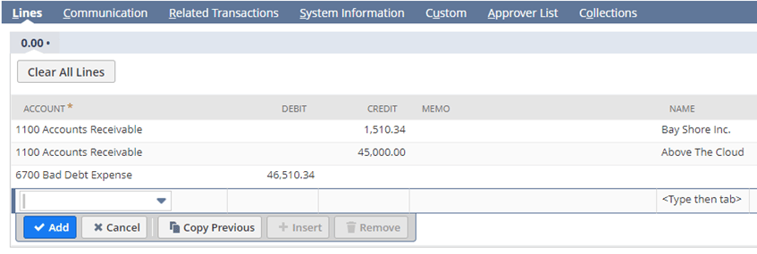

- On the Lines subtab:

-

- Enter a credit to A/R:

-

- In the Account field, select your Accounts Receivable account.

- In the Credit field, enter the amount of the invoice for which you do not expect to receive payment.

- In the Name field, select the name of the customer with whom this invoice is associated.

- Enter other information on this line item as necessary.

- Click Add.

-

- Enter a debit to a bad debt account.

-

- In the Account field, enter or select your Bad Debt Expense account.

- In the Debit field, enter the amount of the invoice for which you do not expect to receive payment.

- Enter other information on this line item as necessary.

- Click Add.

-

- Enter a credit to A/R:

-

- Verify that the Out of Balance By Debit and Credit fields are empty, and then click Save.

Secondly, you’ll have to accept the Journal entry as payment on the customers open Invoice. This will close out the open Invoice in NetSuite and clean up your A/R Aging reporting.

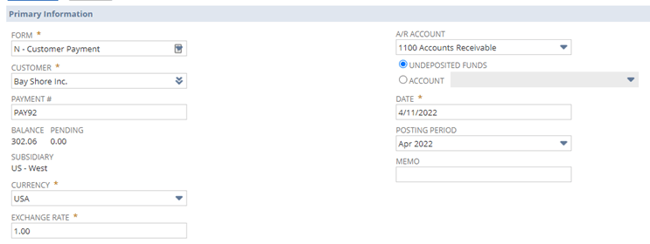

Accept a Customer Payment to Write Off Bad Debt

- Go to Transactions > Customers > Accept Customer Payments.

- In the Customer field, select the customer with the unpaid invoice.

- You can change the Date if appropriate but accept the default choice of Undeposited Funds.

- In the A/R Account field, select a posting account for this transaction.

-

- Only invoices charged to this account show in the list

- Only invoices charged to this account show in the list

-

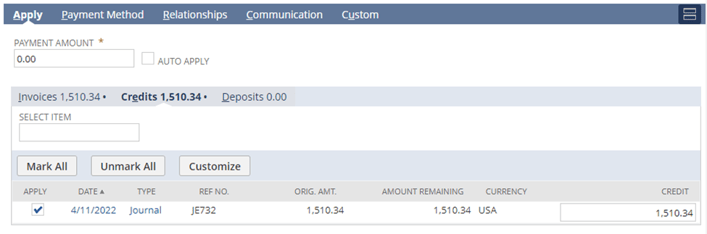

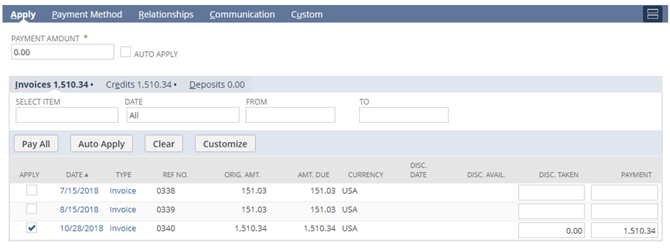

- Click the Apply

- Click the Credits subtab and then check the Apply box for the journal entry you created.

- Click the Invoices subtab and then check the Apply box for the unpaid invoice.

-

- The Payment Amount is automatically set to 0.00.

- The Payment Amount is automatically set to 0.00.

-

- Click Save.

About Us

Concentrus is a complete NetSuite solutions provider that guides organizations through how to use NetSuite to reach highly focused business goals and objectives. We provide NetSuite implementation, developer, integration, and customization services to ensure that you have a long-term solution that is tailored to fit your systems, people, and processes.

Read About Our Implementation Methodology

Want more NetSuite Tips and Tricks? Check out our Short & 'Suite videos